Financing India’s Energy Transition by Ahana Kaura

Transitions for Sustainability, Vol. 3, No. 1

Foreword

The science is clear.

We can expect ever worsening global impacts to occur as are being caused by ongoing human activity and increasing global temperatures from carbon emissions. The only chance we really have of avoiding the worst is to succeed at enabling a global low carbon transition. Countries across Asia are critically important in this regard, given that it is fully expected (EIA, IEA) that most global energy demand will come from outside of the so-called developed world by 2040 if not before. Each country will need its own roadmap and transition plan, and will need to take into account how these transition strategies can be paid for and how people will fare. We look here at India, the world’s third largest economy, second largest in Asia, and largest in terms of global population.

Introduction

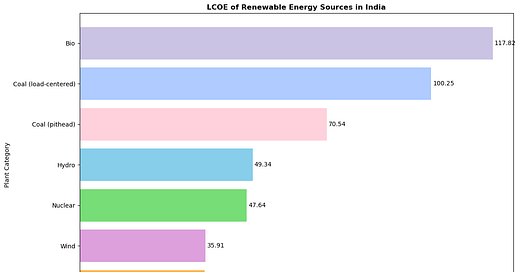

As India has become the third largest emitter globally, the country is coming to address the twin challenges of growing its GDP per capita while minimizing its greenhouse gas emissions. India is a lower-middle income country in terms of GDP per capita, and there is a lot of work to be done to lift its population out of poverty. Nevertheless, India committed to ambitious climate goals at COP26 in Glasgow, aiming to achieve net zero emissions by 2070 and meet 50% of its electricity needs from renewable sources by 2030. To reach this goal, India plans to expand its renewable power generation capacity to 500 GW by 2030. Achieving this ambitious target will require an estimated $160 billion annually from 2022 to 2030, totaling approximately $1.4 trillion over the period. The cost of renewable energy technologies, particularly solar and wind, has been steadily declining, making renewable energy projects increasingly financially attractive. India boasts lower Levelized Costs of Clean Energy (LCoE) for renewable sources compared to coal2. Between 2010 and 2020, the global LCoE for solar and wind dropped over 80%. India saw the largest reduction in country-level solar LCOE, at 85%.10

Exhibit A5 (continued in Appendix)

According to ClimateScope, India holds a power score of 2.67, ranking it first among emerging markets6. This high ranking is primarily due to favorable regulations and market conditions, such as tax exemptions for foreign investments in infrastructure projects and record-high subsidies for electric vehicles (nearly $120 million) and renewable energy ($1.8 billion in FY2023). Although subsidies can create market distortions, they play a crucial role in attracting investment by lowering costs for power producers.

Recent Progress

Schemes like the Production Linked Incentive (PLI) are driving India's renewable energy sector. PLI is fundamental to India's strategy for enhancing its renewable capabilities by boosting domestic manufacturing of solar photovoltaic (PV) modules. With a substantial outlay of INR 24,000 crore (approximately $3.2 billion), PLI aims to establish solar PV manufacturing plants nationwide, driving India's renewable capabilities.13 PLI incentivizes manufacturers to set up integrated facilities that cover the entire production process from polysilicon to modules. In its second tranche, the scheme allocated around 39.6 GW of solar module manufacturing capacity, beneficiaries include established firms like Tata Power, new manufacturing entrants like ReNew and Ampin, as well as First Solar–the only foreign company to make the cut.14 In addition to the PLI scheme, other government initiatives such as the waiver of inter-state transmission charges for solar and wind energy, the establishment of Ultra Mega Renewable Energy Parks, and the promotion of green hydrogen are also contributing to India's energy transition. These measures collectively aim to ensure affordable, reliable, and sustainable energy for all, further solidifying India's commitment to renewable energy.

The top ten Independent Power Producers (IPPs) in India, such as Adani Green, ReNew Power, Greenko, and NTPC, have commissioned a total of 33 GW of renewable energy projects, with an additional 46 GW currently in the development pipeline. As of March 31, 2024, India's installed renewable energy capacity stands at 143.64 GW. In the Union Budget 2023–24, the government set an agenda to deliver “green growth” by allocating 35,000 crore INR (4.4 billion USD) for priority capital investments toward energy transition.11 India’s current net GHG emissions are 2.9 GtCO2e every year (after accounting for 0.3 GtCO2e negative emissions). The bulk of these emissions (70 percent) are driven by five sectors – power, steel, automotive, cement and agriculture.4

IPPs own facilities to generate electric power for sale to utilities and end users. They are the recipients of investment targeting the energy transition in India. Some of the major Indian IPPs by market capitalization are NTPC Limited, Adani Power Limited, Tata Power, ReNew Power, and Suzlon Energy. Greenko is one of India’s leading Renewable Energy companies, replacing fossil fuels with integrated decarbonized energy and grid assets enabling sustainable and affordable energy, with a net installed capacity of 7.5 GW across 15 States in India. Greenko is backed by some of the largest sovereign wealth funds ADIA and GIC.1

Debt and Equity Financing

Private equity (PE) is pivotal in advancing India's energy transition by providing essential capital and expertise for renewable energy projects. In the first half of 2023, the energy sector accounted for about 21% of PE capital deployed, underlining its significance. Major investments include deals in Greenko Energy, ReNew Power, CleanMax, and Adani Green Energy. These investments align with India's renewable energy targets and foster innovation. ESG-focused investments have surged, totaling $4.5 billion, highlighting the growing importance of sustainability. Prominent investors like CPPIB, GIC, ADIA, and KKR have been instrumental, contributing nearly 50% of the $24 billion in ESG investments since 2018.8

Debt financing for renewable energy projects in India comes from diversified sources. From 2019 to 2021, 50% of debt originated from overseas financiers, including foreign banks, development finance institutions, and investment funds. Lenders evaluate project developers based on commissioning timelines, past project performance, fund-raising history, and sponsor credibility. For new IPPs, the management team's credibility and industry experience are crucial. As of 2021, lower debt rates have favorably impacted renewable energy project financing. Major Indian IPP issuers of green bonds from 2019 to 2021 include Greenko, ReNew Power, Adani Green, and Azure, collectively raising $9.7 billion through green bond issuances, which are preferred over traditional loans for refinancing.7

Exhibit B: Debt Financing Breakdown7

India's equity investment landscape for renewables is characterized by IPPs raising capital from a diverse array of sources, including sovereign wealth funds (SWFs), oil and gas majors, global investment funds, foreign utilities, Indian conglomerates, and government companies. The Indian government offers 100% income tax exemptions for SWFs investing in infrastructure, including renewable energy. This policy, introduced in 2020, has significantly attracted foreign investment.12

Notably, eight SWFs hold equity stakes in India’s renewable power producers. For instance, the Abu Dhabi Investment Authority (ADIA) and GIC bolstered their investment in Greenko with a $0.7 billion capital raise; British Columbia Investment Management Corporation (BCI) and APG Asset Management supported Mahindra Susten, which has nearly 6 GW of generation capacity; and the Qatar Investment Authority (QIA) acquired a 3% stake in Adani Energy. Other notable SWF-backed Indian renewable platforms include Azure Power backed by OMERS and CDPQ, ReNew Power backed by CPP Investments and ADIA, and Tata Power backed by Mubadala.9

Perspectives

An ESG Investor at an APAC-based SWF shared that institutional investors like SWFs recognize the need to support renewable energy projects. He emphasized the importance of selecting project partners with proven track records in specific renewable technologies (like offshore wind) and reliable grid operations, crucial for ensuring stable revenue streams. Despite the mature state of the renewable sector, he finds the Indian market attractive due to robust government support, including significant investment targets and incentives like tax breaks and secured contracts. He noted the importance of projects with large captive capacities and Power Purchase Agreements (PPAs) with well-defined customer bases to assess demand effectively.

The investor also stressed the vital role of innovation in bridging the supply-demand gap, highlighting advancements in battery technologies and decentralized distribution models, such as renewable-powered EV charging stations. Looking ahead, he sees significant investment opportunities in transitioning from traditional to renewable energy sources, not only in power generation but also in everyday applications like stoves and two-wheelers, through the adoption of electric or hybrid technologies and intermediate battery distribution systems that are affordable and accessible.

According to an ESG leader in commercial banking, the sector contributes approximately 5% of loans towards green financing, primarily for solar, wind, hydro, and hybrid renewable energy projects, as well as EV infrastructure. Despite the potential, banks remain cautious due to the long gestation periods and uncertain revenue models of these projects. A significant challenge is the asset-liability mismatch, where banks use short-term deposits to fund long-term loans, making financing renewable projects difficult and expensive. To address this, banks are exploring innovative financial instruments like infrastructure bonds to meet long-term funding needs.

Government support is crucial for the profitability of renewable energy projects. Power distribution companies need to demonstrate positive cash flows through high-rate Purchase Power Agreements (PPAs), but finding buyers willing to pay these rates is challenging. Public sector banks tend to adopt a more aggressive pro-government stance in financing projects, while private banks prioritize maintaining steady financials. The Union Government is also encouraging take-up of renewables through ministries e.g. MSMEs are encouraging SMEs to transition to a green economy.

Recent insights from the Mercom India Renewables Summit15 provide valuable perspectives from developers, implementation agencies, and governmental entities on the advancements and challenges in the renewable energy sector. During the summit, Sudeep Jain, Secretary of the Ministry of New & Renewable Energy (MNRE), highlighted that India has surpassed 200 GW of renewable energy capacity, with ambitious plans to add an additional 300 GW by 2030. This milestone reflects the country's strong commitment to expanding its renewable energy portfolio and sets a robust foundation for future investments.

Exhibit C: Mercom India Renewables Summit Panel

Sujoy Ghosh, VP and Country MD India at First Solar, shared that the company's first vertically integrated plant produces 85% of its modules with glass. The exemption of tariffs on solar glass imports has been beneficial, and under the PLI scheme, the company aims to localize 70% of its production. However, grid constraints remain a significant challenge. Ghosh noted that First Solar's panel costs are competitive in India compared to Southeast Asia, and they can attain cost parity with China. Prashant Mathur, another leader in the domestic manufacturing space and CEO of Saatvik Solar, emphasized the shift towards TOPCon cells, which have replaced Mono PERC as the preferred choice due to their efficiency and versatile applications in utility-scale solar farms, EV charging, and agriculture. The reimposition of the ALMM by the Ministry of New and Renewable Energy has driven developers back to Indian manufacturers, with 50% of ALMM capacity being TOPCon.

With hybrid energy solutions discussed at the summit, various developers shed light on their progress. Sunil Gupta, CEO of Azure Power, highlighted the uniqueness of the Indian market, where developers secure 25-year fixed-price contracts for renewable energy purchases. These long-term contracts incentivize developers, with significant demand from the Commercial and Industrial (C&I) sector. Gupta also noted the market's price sensitivity and the absence of fast-response options for intermittent energy sources. The FY23 merchant market clearing price exceeded 6 INR. Purnendu Chaubey, VP at ReNew, discussed how developers are increasingly prioritizing storage solutions over wind projects to address intermittency issues that pose constraints to the grid. An implementing agency representative stressed the need for new tenders to incentivize various hybrid technologies and include storage provisions, encouraging innovation and investment in these areas.

The summit featured leading perspectives on scaling green hydrogen to build a competitive marketplace. Chirag Kotecha, CEO of Matrix Gas and Renewables, shared that their portfolio includes an electrolyzer supporting green ammonia production, with an initial CapEx exceeding 500 crore INR. The firm’s strategy includes decentralized hydrogen production using an alkaline electrolyzer. Rajat Sabsaria from Adani Group highlighted Adani's focus on land acquisition for hydrogen production, with current holdings capable of producing up to 47GW of hydrogen. Adani integrates ammonia into its port ecosystem, demonstrating a comprehensive supply chain approach. Prashant Choubey, CEO of Avaada, discussed the company’s 700 MW electrolyzer production capacity and its east coast plants catering to hydrogen markets in Japan and Korea. The goal is to reduce hydrogen costs to 2 INR/KwH by optimizing the value chain. Sandeep Kashyap, CEO of RP Sanjiv Goenka Group, noted that of the 6.7 million tonnes of green hydrogen consumed in the country, a significant portion is in the derivative market, especially shipping. He emphasized the importance of securing hydrogen connectivity through purchase agreements, land availability, and long-term bank guarantees. Approximately 60% of hydrogen produced in India is expected to be exported, with Japan as a major market.

Exhibit D: ChemAnalyst India Hydrogen Market & Projections

Risks and Opportunities

IRR figures for renewables (average between 9-11%) reflect the financial performance and attractiveness of renewable energy investments in the Indian market, which continue to benefit from declining technology costs and supportive government policies. Solar projects in India have an average post-tax equity Internal Rate of Return (IRR) of 13.3%. However, expected equity IRRs are falling due to rising CapEx on materials such as copper, cement, and steel, which may squeeze equity premiums. In this evolving landscape, Infrastructure Investment Trusts (InvITs)—similar to Real Estate Investment Trusts (REITs)—are becoming an attractive avenue for IPPs to monetize operational projects. InvITs could offer increased investment opportunities due to the liquidity of these assets, although frequent regulatory changes have deterred some investors. Outside of REITs and InvITs, innovative financial mechanisms include securitization of singular project cash flows, pass-through certificates (PTCs), and blended finance instruments (appendix).

Risks for renewable projects in India exist along three dimensions: regulatory, project and financial. Regulatory risks include policy challenges and approval delays. For instance, many states have signed with the IPPs to lower the tariffs. However, projects can become financially unviable due to retroactive tariff cuts. Financial risks include higher borrowing costs, macroeconomic factors like high inflation, downgrade of sovereign credit rating, and depreciation of the Rupee which affects servicing of fixed dollar-denominated debt and cost of importing equipment. Project risks include land unavailability and grid instability and extreme weather. Mitigating regulatory risks for operational projects can be challenging. Strategic planning is crucial to navigate and manage the future risks associated with a high-renewables market.6

Despite these risks, however, the market can be improved through innovative financial mechanisms like the InvITs and green bonds mentioned above. Other notable financial tools include Virtual Power Purchase Agreements (VPPAs) and Contracts for Difference (CfDs)3. VPPAs help renewable project owners secure financing while allowing purchasers to meet renewable energy targets and potentially profit from rising energy prices. If the market price of energy falls below the fixed price, the buyer compensates the project owner, and if it exceeds the fixed price, the project owner compensates the buyer. CfDs set a fixed price for energy, providing both parties with protection against price volatility. Additionally, the government has announced plans for 50GW of annual tenders for various energy contracts. Tenders can encourage project builders to come up with new, smart ideas to win the bid for the project, translating to better, more innovative solutions for renewable energy.

Conclusion

India's renewable energy sector presents a dynamic landscape characterized by significant government support, diverse investment sources, and favorable market conditions. The ambitious targets for net-zero emissions by 2070 and 50% renewable electricity by 2030 are driving substantial investments and technological advancements. Despite the progress, challenges such as rising CapEx and regulatory risks persist. Foreign investment is challenged by currency non-convertibility given the long-term horizon of the projects. However, innovative financing mechanisms like InvITs and strong policy incentives, including the PLI, continue to attract global investors. Given India's colossal challenge of developing while transitioning equitably, it can aid other countries by providing a policy blueprint and replicable innovative financial mechanisms. Additionally, India can assist by exporting renewable energy products, such as green hydrogen derivatives, to other APAC countries. With strategic planning and robust risk management, India remains poised to lead in the global renewable energy transition.

References

"About Greenko Group." Greenko Group, https://www.greenkogroup.com/about.php. Accessed 13 June 2024.

Birol, Fatih, and Amitabh Kant. "India’s Clean Energy Transition Is Rapidly Underway, Benefiting the Entire World." International Energy Agency, 10 Jan. 2022, https://www.iea.org/commentaries/india-s-clean-energy-transition-is-rapidly-underway-benefiting-the-entire-world. Accessed 13 June 2024.

Garg, Vibhuti. "Scaling Clean Energy: Financing and Transition Strategies for India's Sustainable Future." The Economist Impact, https://impact.economist.com/sustainability/net-zero-and-energy/scaling-clean-energy-financing-and-transition-strategies-for-indias.

Gupta, Rajat, et al. "Decarbonising India: Charting a Pathway for Sustainable Growth." McKinsey & Company, 27 Oct. 2022, www.mckinsey.com/capabilities/sustainability/our-insights/decarbonising-india-charting-a-pathway-for-sustainable-growth. Accessed 19 June 2024.

IEA (2020), Levelised Cost of Electricity Calculator, IEA, Paris. https://www.iea.org/data-and-statistics/data-tools/levelised-cost-of-electricity-calculator

"India." Climatescope, BloombergNEF, https://www.global-climatescope.org/markets/in/. Accessed 13 June 2024.

Jaiswal, Shantanu, and Gadre, Rohit. Financing India’s 2030 Renewables Ambition. BloombergNEF, 22 June 2022.

Krishnan, Sriwatsan, Aditya Shukla, Prabhav Kashyap, and Aakriti Gupta. "India's Private Equity Landscape in the First Half of 2023." Bain & Company, https://www.bain.com/insights/indias-private-equity-landscape-in-the-first-half-of-2023/. Accessed 16 June 2024.

"Playing a Role in the Green Energy Transition, Sovereign Wealth Funds and Public Pensions Surge in Renewable Investments." Sovereign Wealth Fund Institute, 15 May 2023, https://www.swfinstitute.org/v1/news/94581/playing-a-role-in-the-green-energy-transition-sovereign-wealth-funds-and-public-pensions-surge-in-renewable-investments. Accessed 13 June 2024.

"Power." IECC, Berkeley India Energy and Climate Center, https://iecc.gspp.berkeley.edu/impact-areas/power/. Accessed 13 June 2024.

Raizada, Swasti, et al. "Mapping India's Energy Policy 2023: A Decade in Action." IISD, www.iisd.org/story/mapping-india-energy-policy-2023/. Accessed 19 June 2024.

Rao, Archana. "Sovereign Wealth Fund Investments in India: Outlook in 2024." India Briefing, 11 June 2024, https://www.india-briefing.com/news/sovereign-wealth-fund-investments-india-outlook-2024-31398.html/. Accessed 13 June 2024.

"Renewable Energy." Invest India, https://www.investindia.gov.in/sector/renewable-energy. Accessed 13 June 2024.

"Solar PLI Tranche 2 Allocations Released, 48 GW Of Domestic Manufacturing Capacity By 2025-26." Saur Energy International, www.saurenergy.com/solar-energy-news/solar-pli-tranche-2-allocations-released-48-gw-of-domestic-manufacturing-capacity-by-2025-26. Accessed 19 June 2024.

Mercom India Renewables Summit. Mercom India, 25-26 July 2024, New Delhi, India.

Appendix

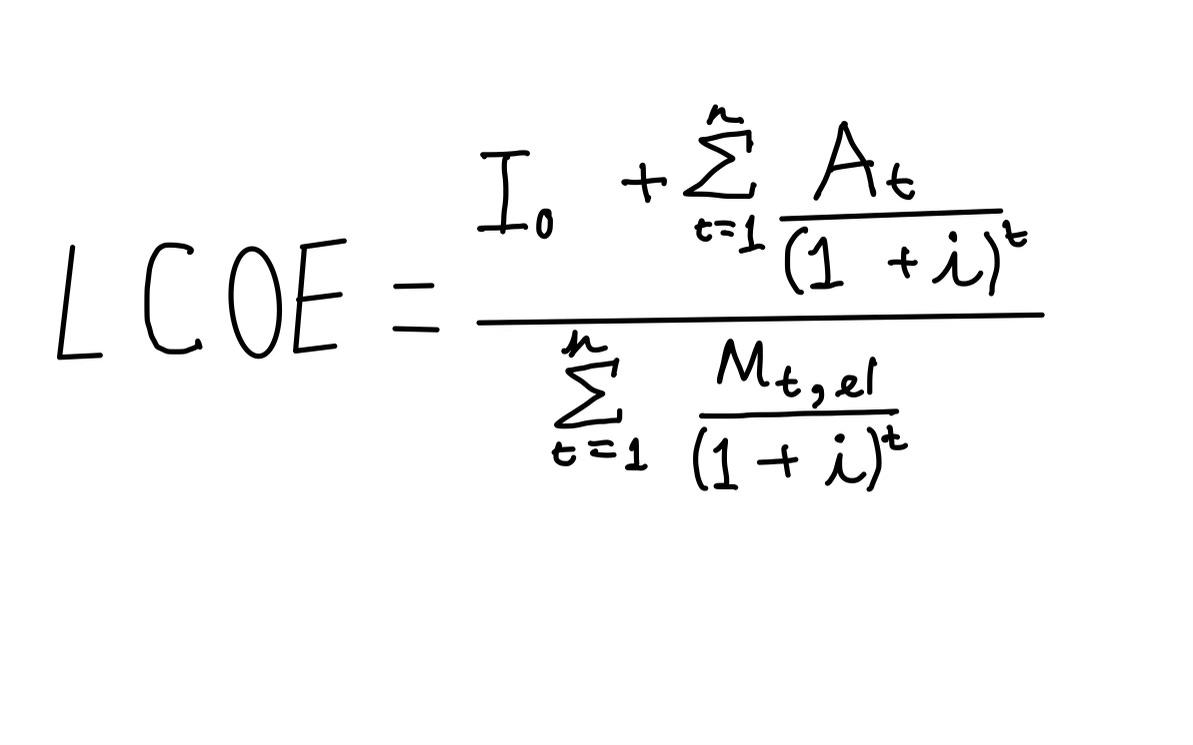

Levelized Cost of Energy (LCoE)

LCoE = NPV of project costs / NPV of electricity produced

It = Investment Expense in USD

At = Annual total cost per year in USD

Mt,el = Amount of electricity produced in year t in MWh

i = interest rate in year t

Source: International Energy Agency

ClimateScope’s Methodology

Climate Scope ranks the power sector on the following parameters:

Fundamentals such as a market’s key policies, market structures and barriers to the deployment of investment.

Opportunities that examine a market’s potential to grow its supply of renewable power and clean transport.

Experience that assesses a market’s achievements to date across the three sectors. Markets with greater experience deploying renewable power capacity typically offer lower risks, lower technology costs and lower costs of capital for developers.

Blended Finance

Blended concessional finance, or blended finance, combines concessional finance from donors or third parties alongside development finance institutions’ (DFIs’) normal own account finance and/or commercial finance from other investors, to develop private sector markets, address the Sustainable Development Goals, and mobilize private resources. (IFC)

Investments in emerging and frontier markets often fall short of commercial investors' risk-return expectations. To attract private capital, real or perceived risks—such as macroeconomic, regulatory, credit, technical, off-take, or market risks—must be managed, mitigated, or transferred from the private sector to donors. According to IFC, the first blended finance loan in India in nearly a decade was committed in 2023 after overcoming the withholding tax obstacle for blended finance structures.

Blended Finance Instruments attract funding from both public and private sectors to support renewable energy projects:

Institutions with Different Risk Appetite: Engage a range of institutions, each with varying levels of risk tolerance.

Multilateral Agency Involvement: Provide mezzanine debt to fill the gap between senior debt and equity.

First Loss Default Guarantee: Protect investors from initial losses, reducing perceived risk and encouraging private sector investment.