Carbon Capture and Storage: How to Ensure its Role in the Energy Transition? by Luis de la Torre

Transitions for Sustainability, Vol. 2, No 1

An amazing Harvard Extension School class in Fall 2023 produced excellent work in the category of envisioning how to potentially solve what remain as unsolved sustainability challenges, the sort of work that inspired our Sustainable Innovation and Impact book five years ago, and this subsequent Transitions for Sustainability (TFS) website as well. Will the student’s work become a book on its own? That’s what the 56 student essays felt like to me anyway, they were all excellent and on diverse, important topics. Will those essays become its own website such as this? We will see.

Here’s a first example of the excellent work of this class envisioning ways forward, complications, barriers and all.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Carbon Capture and Storage and Use, How to Ensure its Role in the Energy Transition?

Carbon Capture & Storage & Use (CCSU) is a geoengineering technique with many challenges ahead to become a global solution at a large scale in the current energy transition, with a high impact on climate change and the sustainability of many businesses. CCSU could be the center of many permanent and temporal CO2 reductions if combined with Power-to-X (PtX) options to produce advanced chemistry and e-fuels (Gowd et al., 2023).

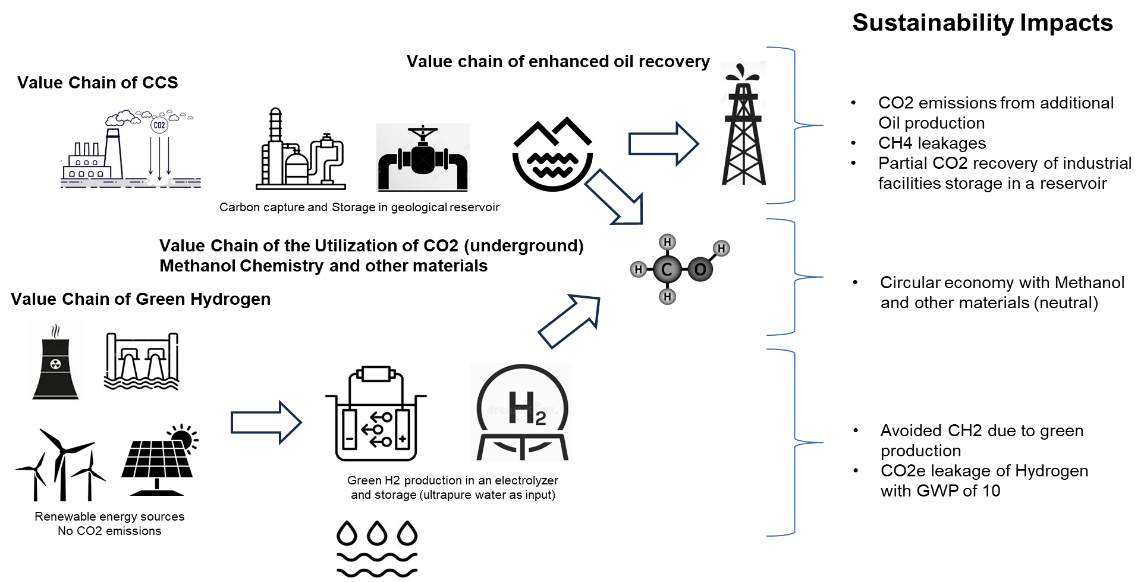

Figure 1 shows the four large-scale energy value chains related to CCSU. The first one is the combination of processes to gather CO2 from industrial facilities, use amines for capture and later regeneration, supercompression for transformation of CO2 in the liquid phase, and dehydration to pump liquid CO2 to a geological reservoir. Here, there is connectivity to the partial use of this CO2 for enhanced oil recovery (EOR), which is a relatively important market if the oil price is over 70 USD/barrel. The next important value chain is feedstock production for chemistry through green Hydrogen (H2). The potential uses are Methanol and construction materials.

Figure 1

Sustainability Impacts of Processes Connected to CCSU

Source: Author’s own elaboration

This paper hereby reviews evidence of such technological developments and the economics of CCSU and summarizes the potential scenarios and policy implications for an effective role of CCSU in this century and its impact on its sustainability.

Status of CCSU development by the end of 2023 and beyond

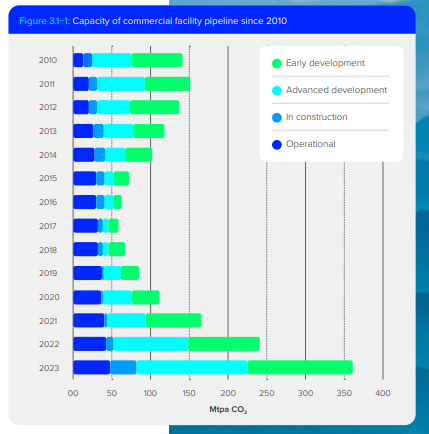

CCSU, as a climate solution, has less than two decades in the market, and most of its technology comes from the Oil and gas industry. It is an expensive solution that starts with a capture cost of over 80 USD/tCO2 and adds other variable costs according to the length of the transportation and conditions of the geological storage. Figure 2 shows the current state of these projects; around 50 projects worldwide are fully operational, and 300 are in the pipeline with average project timing from engineering to completion of 7 years and targeting an average storage capacity of 25 MtCO2 per reservoir.

Figure 2

Capacity of commercial facility pipeline since 2010

Source: CCS Institute Global update 2023

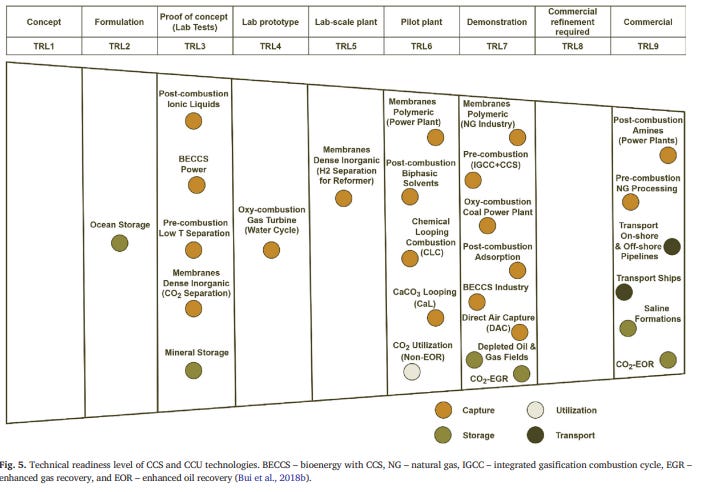

This confirms the small initial market penetration of CCSU in the climate crisis, but it is not a real picture of its potential and what will come. A look at the technological readiness of CCSU confirms that most of the components are between TRL7 and TRL9. Figure 3 shows that most components of this geoengineering solution are moving to the commercial stage and gaining momentum (Global CCS Institute, 2023).

Figure 3

Technological readiness level of CCSU technologies, BECCS-Bioenergy with CCS, Integrated Gasification Combustion Cycle, Enhanced Oil Recovery with CO2

Source: Bui et al., 2018

A careful look at the portfolio of current projects confirms most developments in upstream Oil and Gas operations, as energy companies see CCSU as an option to improve the economics of used wells, onshore or offshore, or fulfill their climate obligations with low costs. The other applications have focused on coal-based power plants with options to send the CO2 to old oil fields as an Enhanced Oil Recovery resource.

The future applications of the captured CO2 might start from the geological reservoir as an intermediate step to be combined with other processes and services and generate a circular economy. These options include the CO2-to-chemicals pathway to produce methane, methanol, Urea, Syngas, and Polycarbonate. Options that transform the CO2 to minerals can improve concrete curing or carbonate blocks for construction (limited by logistics costs). A third path is a biological transformation to algae cultivation and enzymatic conversion (limited by the energy required to remove excess water). The main barrier to these concepts is the high cost of green energy (mostly Hydrogen) to activate the transformation. Moreover, social barriers are becoming another issue for CCSU and Hydrogen projects as communities, and NGOs have expressed concerns about the safety of their lives in case of leakage or the effects on water availability as cheap water is the usual first option for supplying electrolyzers with ultrapure water[1].

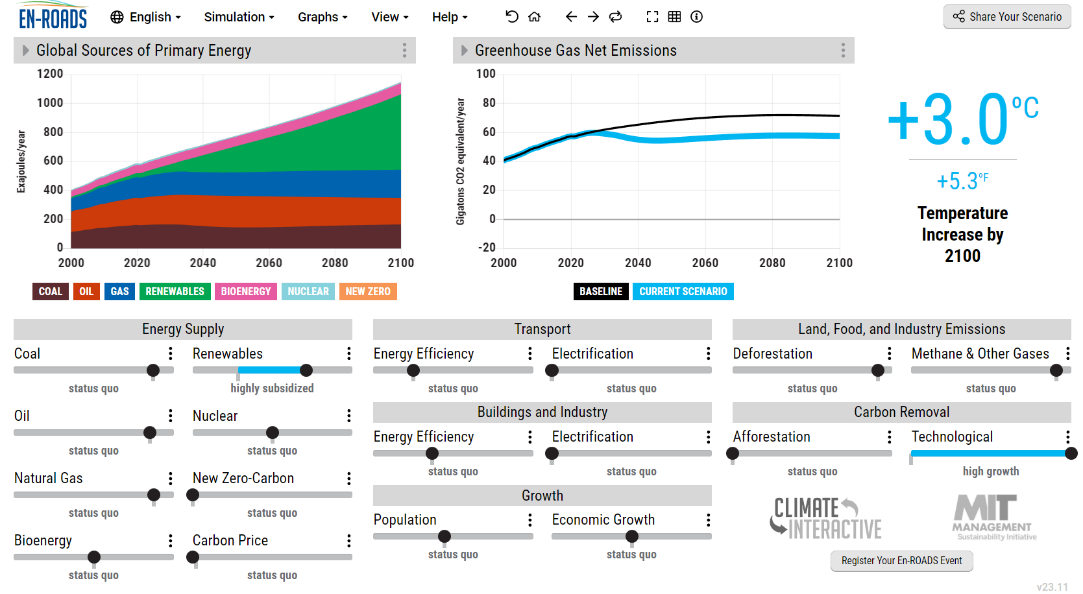

If we model CCS in large or small-scale options and hydrogen in a Business-As-usual scenario, the results are modest in any integrated assessment analysis. Figure 4 shows this analysis in one of the best climate market applications, MIT EN-ROADS. The use of CCS plus highly subsidized renewable energy reduces the temperature by 0.4 oC during the rest of the century (the BAU scenario has 3.4 oC in equilibrium at the end of the century), which is not significant if compared to carbon taxes or energy efficiency.

Figure 4

Forecast to 2100 in EN ROADS for CCS + RE

Source: https://www.climateinteractive.org/en-roads/

The explanation, beyond the high cost of this solution, is the long project cycle for this solution, absence of connectivity with feedstock processing, and lack of coordination between countries to generate a global market to take advantage of the best sites and demand.

The externalities of Green Hydrogen and other products related to CCSU.

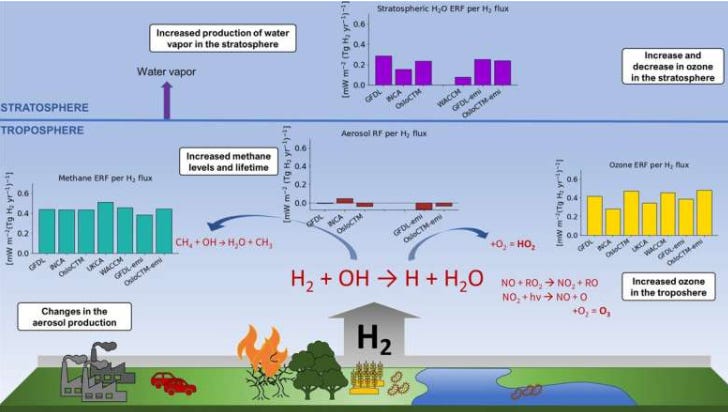

All the solutions under the umbrella of PtX require efficient use of green hydrogen, competitive logistics (due to weight), and a strong demand side for new products with environmental integrity. Green hydrogen, which is a straightforward solution, is at the center of this challenge. However, the current efficiency of electrolyzers (~80%), the low thermal efficiency if transformed to liquid (~55%), and later use with low efficiency in power cells makes the solution economically unattractive. Moreover, Hydrogen is a tiny molecule and tends to generate corrosion and leakage in pipelines, valves, and equipment. In addition, there is an externality due to potential leakages; the theoretical global warming potential of H2 is around ten times CO2 in a 100-year time horizon. This element does not absorb infrared radiation and could reach the atmosphere if the storage systems have leakages. H2 has a proven influence on the chemistry of the troposphere and stratosphere by increasing the lifetime of methane, the tropospheric concentration of Ozone, and the concentration of water vapor, a greenhouse gas. Figure 5 summarizes the potential H2 climate impact of leaks in production, storage, or transportation based on a report by CICERO[2] in Norway (Warwick et al., 2022).

This externality requires further research and official valuation of their damage by technical bodies like the Intergovernmental Panel on Climate Change (IPCC). However, making an analogy with methane, the leaks are feasible, and they subtract part of the benefits of H2 to sustainability.

Figure 5

CICERO Analysis of H2 leaks climate impact (based on 1 Tg H2 as flux)

How to improve the sustainability case for CCSU in the context of the energy transition

There is no doubt of the impact of retiring CO2 or replacing carbon-based fuels with green hydrogen, but the sustainability of these options is still a work in progress. The focus of the significant improvement of its economics and large-scale deployment is a pivotal price of hydrogen below future fluctuations of oil products. Most specialists see this value as around 1.5 USD/Kilogram of hydrogen. Furthermore, there will be a big leap in energy negotiations in the future, as this price might be “flat” due to its manufacturing nature, which is an advantage against the volatility of oil as a commodity.

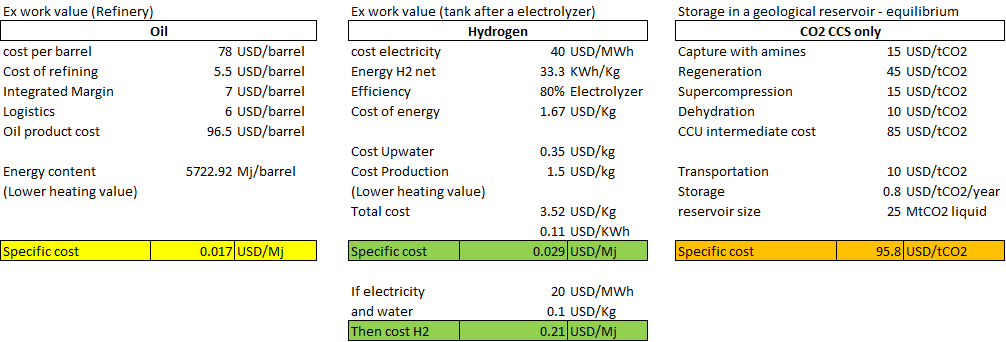

This exercise is summarized in Table 1, an estimate of the ex-work values of refined oil products, which have volatile prices versus liquid hydrogen after an electrolyzer. To close the gap between an ex-works cost of oil product of 0.017 USD/Mj versus Hydrogen starting at 0.029 USD/Mj, hydrogen needs to cut its costs by over 50%. The reductions will come from lower costs of green electricity and ultrapure water. Additional effects are expected in higher efficiencies, cheaper maintenance, better catalyzers of electrolyzers, and economies of scale for equipment manufacturing and demand.

Table 1

Referential cost of H2 versus oil products and CO2 (ex-works)

Note: own elaboration, data from IEA 2023

This gross analysis shows a few immediate elements to improve the sustainability of CCSU/H2 over the next two decades:

1. OECD economies should put higher efforts into R+D to improve the efficiency of electrolyzers, their maintenance, and catalyzers and generate financial incentives for larger manufacturing capacity. The same effort is required for amine regenerators, supercompression systems for CO2, and transportation systems by pipelines and ships of liquid CO2 and other feedstocks. This impacts SDGs 8 and 9. There are some examples of this type of effort, like the American[3] IRA, the German[4] national strategy, or the Japanese[5] strategy. All these initiatives include mixed options of CCSU and hydrogen. As shown in Table 1, CO2 capture and storage costs start at around 100 USD/ton, and a reduction of 70% is required to have a profitable business case. Most tax credits and other incentives are needed for the processing facilities and transportation that account for most operational costs.

2. Further research is necessary to confirm the GWP of hydrogen leaks and model these externalities in pipelines and equipment to have a complete overview of benefits and environmental damages (SDSGs 12 and 13).

3. CCSU requires trading conditions to build economies of scale at regional and international levels. Countries must participate with the best sites for green energy and utilization of reservoirs connected to industrial sites or coal-based power plants.

4. The production of ultrapure water requires international coordination and cooperation to avoid social stress if clean water is diverted from agriculture or human consumption and the management of waste coming from solutions based on seawater. This is to prevent damage to SDG 6.

5. The UN must start a global campaign to show the challenges of CSSU in the next decades, explaining what it means for SDGs and their potential role in climate. There are lessons to be transferred from the development of liquified natural gas, which required many decades to be a viable option with less emissions than coal-based power plants. The shorter the project cycle, the better it is to start reducing emissions.

6. Methanol and construction materials based on CO2 are options limited by the current state-of-the-art catalyzers, the efficiency of plants, and the high logistics cost. These options require further effort on R+D and fiscal incentives to start sustainable supply chains of these materials in the global markets.

7. Further policymaking to improve the points source capture planning could enhance the performance of future systems by generating efficient hubs for capture and delivery to ports, ships, and pipelines. Most CCSU hubs will be based around industrial clusters, where emission sources are close, as in the East Coast Cluster or China’s Junggar Basin. However, some will be geographically scattered, collecting emissions sources by pipeline or ship, as in Northern Lights in Norway and a series of planned hubs in the Asia-Pacific region. The hubs bring many benefits, including lower unit costs, reduced risk, and the ability to standardize and scale up quickly. For emitters, the hub offering opens up as a decarbonization option.

The case for cheaper green electricity is not an issue for the future development of CCSU. This sector has gained momentum, and levelized costs are around 40 USD/MWh, competing with coal-based power. The power sector knows a huge demand for hydrogen and electricity will come from developing economies. Most experts estimate the future costs below 20 USD/MWh before 2030. The overall sustainability case has other aspects or positive SDGs, such as job creation, indirect air quality improvement, avoidance of oil spillage, and other waste. But all future development requires a broader perspective, thinking on a large scale to dilute costs.

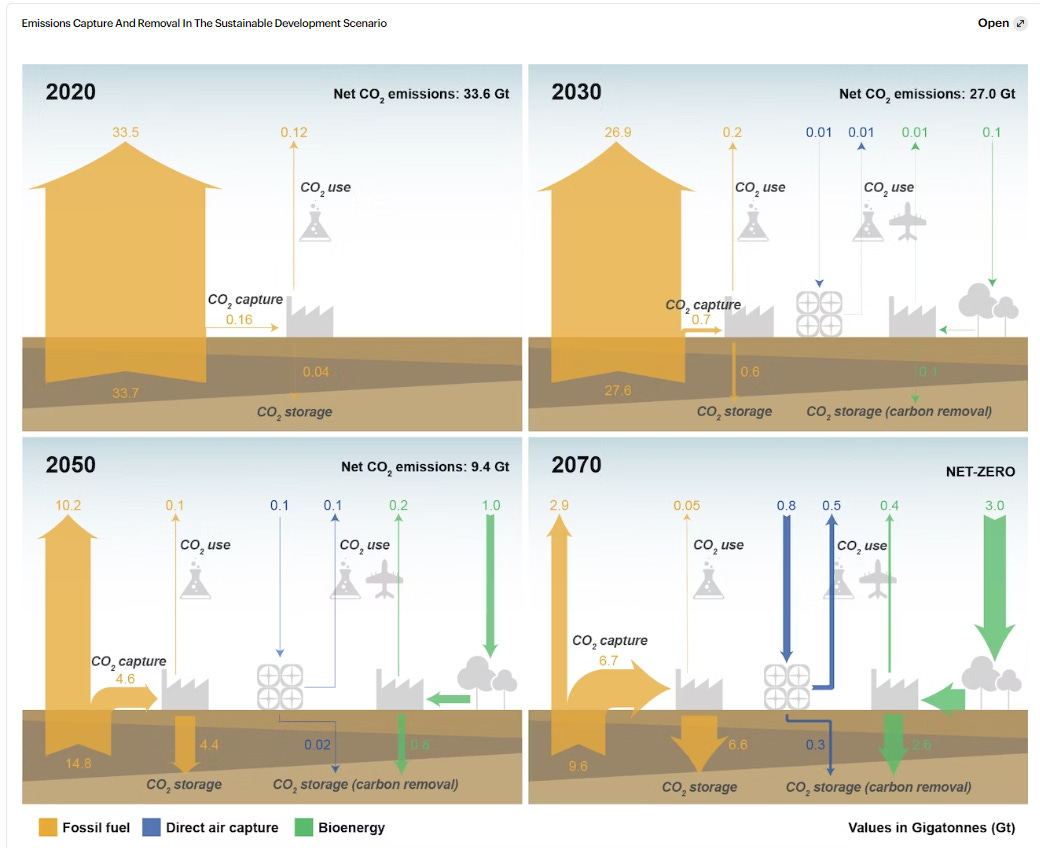

Consequently, if all the conditions happen, the impact on global sustainability and the role of CCSU will be present after 2050. The following figure shows a conservative analysis done by the International Energy Agency. This scenario indicates a strong positioning of CCSU between 2050 and 2070, including utilization as feedstock and combined with energy products such as e-fuels under a PtX scheme. The major flows are not limited to coal-based power generation or industrial fumes. There is a need for negative emissions based on biomass burning, capturing their fumes (BECCS), and direct air capture in main cities with large automotive fleets.

Figure 6

Emissions Capture and Removals in the Sustainable Development Scenario of IEA

Conclusion

The review of the academic and corporate literature on geoengineering solutions based on carbon capture and storage and utilization confirms it is still a work-in-progress solution, and there is a need for higher economies of scale and connectivity of all the options that CCSU has for this energy transition. Most models predict CCS's role and connectivity to green hydrogen utilization, capturing more than 4.6 GtCO2 after 2050. Thus, it is possible to affirm that geoengineering with storage of CO2 and later industrial use is a feasible option for the climate fight with 20 years ahead of implementation, proof of concept, and commercial applications for some processes. For ESG funding, this means opportunities to engage in different energy options that will happen in most countries and will generate new industries.

The feasibility is demonstrated at the operational level, but work is needed to increase efficiencies and develop further chemical knowledge to harness the bulk CO2. Many lessons can be learned from the LNG industry to avoid long project planning and construction. The key variables in the core of CCSU and related systems are capital expenditure, operational costs, thermal efficiencies, lifetime, leakages, waste, and scale.

Most integrated climate assessment systems have options for following CCSU and agree with IEA and other agencies in their role in this climate crisis. There is room for further analysis using systems dynamics and following up their path to economies of scale.

References

Bloomberg NEF. (2020). Hydrogen Economy Outlook. Retrieved from https://data.bloomberglp.com/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf

Bonciu, F. (2021). The Dawn of a Geopolitics of a Hydrogen-based Economy. The Place of European Union. Romanian Journal of European Affairs(2), 95-113. https://www.ceeol.com/search/article-detail?id=1001634

Becattini, V., Gabrielli, P., & Mazzotti, M. (2021). Role of Carbon Capture, Storage, and Utilization to Enable a NetZero-CO2‑Emissions Aviation Sector. I&EC Research, 6848-6862. https://dx.doi.org/10.1021/acs.iecr.0c05392

Gowd, S., Ganeshan, P., Vigneswaran, V., Hossain, S., Kumar, D., Rajendran, K., & Ngo, H. (2023). Economic perspectives and policy insights on carbon capture, storage, and utilization for sustainable development. Science of the Total Environment, 883. http://dx.doi.org/10.1016/j.scitotenv.2023.163656

Global CCS Institute (2023). Global Status of CCS 2023: SCALING UP THROUGH 2030. Retrieved from https://status23.globalccsinstitute.com/

International Energy Agency (2023). CO2 Storage Resources and their Development. An IEA CCUS Handbook. Retrieved from https://www.iea.org/energy-system/carbon-capture-utilisation-and-storage

Manion, M., Rabe, B., Emilio, L., Wang, Y., Martel, R., Tvinnereim, E., . . . Maosheng, D. (2019). The Role of Carbon Pricing in Deep Decarbonization. One Earth, 1(1), pp. 7-9. Retrieved from https://doi.org/10.1016/j.oneear.2019.08.020

Rahman, D., Neal, P., Amal, R., Ali Khan, M., & MacGill, I. (2021). A framework for assessing the economics o blue hydrogen production from steam methane reforming using carbon capture storage & utilisation. International Journal of Hydrogen Energy, 46. Retrieved from https://doi.org/10.1016/j.ijhydene.2021.04.104

Warwick, N., Griffiths, P., Keeble, J., Archibald, A., & Shine, K. (2022), Atmospheric Implications of increased hydrogen use, Department of Business, Energy and Industrial Strategy. Retrieved from www.gov.uk/government/publications/atmosphericimplications-of-increased-hydrogen-use

Endnotes

[1] Ultrapure water is water that has been purified to high levels of specification. As a standard, the water contains only H20, as well as a balanced number of H+ and OH- ions. It has a resistivity of 18.2 MΩ.cm, TOC < 10 ppb, and bacterial count <10 CFU/ml. This level of purity makes it suitable for splitting in an electrolyzer. The typical consumption ratio is 17 Kilos of clean water/Kilo of Hydrogen.

[2] See other studies on H2 externalities at https://cicero.oslo.no/en

[3] See https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

[4] See https://www.bundesregierung.de/breg-en/news/hydrogen-technology-2204238

[5] See https://www.meti.go.jp/english/policy/energy_environment/global_warming/roadmap/innovation/thep.html